- The deposits itself depends on the relationship and type of acct you have, for example if the acct is open less than 3 months is '$XXXX.XX' compare to an acct.

- Before snapping photos of her money order with Bank of America's mobile deposit app, April took the time to make sure that money orders were permitted. She lives 200 miles away from the nearest.

- The description of the deposit in your account will include the words 'IRS' and TAXEIP' How can I deposit my paper check without visiting a Financial Center? Download our Mobile Banking app. In the app, you can deposit a paper check, using a photo image, and get confirmation immediately that your deposit has been received.

- Bank Of America Mobile Deposit Max

- Bank Of America Mobile Deposit Limit

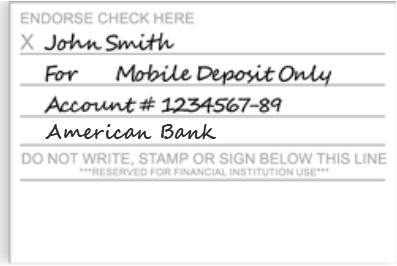

- Bank Of America Mobile Deposit Endorsement

Point. Click. Deposit. See how easy it is to deposit a check using the MyMerrill Mobile app!

Bank of America will never request your information in this way Claims that your account may be closed if you fail to confirm, verify or authenticate personal information are not from Bank of America If you receive a suspicious email or are directed to a website that also looks like Bank of America, report it to email protected and then.

MyMerrill Mobile Check Deposit

Mobile Check Deposit on the MyMerrill mobile app allows you to securely and conveniently deposit checks anytime and anywhere into eligible Merrill investment accounts.

Once you log into the MyMerrill mobile app:

Bank Of America Mobile Deposit Max

- Tap on the check deposit icon.

- Using your device's camera, take a picture of both

sides of the check. - And remember to sign the back.

- Select your deposit to account & enter the

amount. - Tap continue to verify the deposit, and lastly

finally, tap 'make deposit' to process therequest.

A confirmation notice will appear on the screen letting you know it the check was accepted.

- You may can check the status of your deposit at

any time by returning to the app,selecting 'check deposit' and then 'view status.' - Deposits made after 7:30 p.m. Eastern Time will

be processed on the next business day. - It may take up to eight days before you can invest

or withdraw the funds. - The check should be kept for 14 days to ensure

the issuer has honored the payment.

Mobile check deposit provides you a secure and convenient option right from your home!

Important Information:

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as 'MLPF&S' or 'Merrill') makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (BofA Corp.). MLPF&S is a registered broker-dealer, Member SIPC and a wholly owned subsidiary of BofA Corp.

Investment products:

- Are Not FDIC Insured

- Are Not Bank Guaranteed

- May Lose Value

Nothing discussed or suggested in these materials should be construed as permission to supersede or circumvent any Bank of America, Merrill Lynch, Pierce, Fenner & Smith Incorporated policies, procedures, rules, and guidelines.

Neither Merrill Lynch nor any of its affiliates or financial advisors provide legal, tax or accounting advice. Clients should be instructed to consult with their legal and/or tax advisors before making any financial decisions.

© 2020 Bank of America Corporation. All rights reserved.

Personalize your app

Bank Of America Mobile Deposit Limit

Arrange the app's features in a way that makes the most sense to you—on a per-device basis and move things around using the new dashboard feature. View our tutorial for details.

View balances and account activity

Search for transactions, add a note or an image, and filter by tags. Access up to 120 days of account transaction history, then accumulate more history going forward.

Make deposits using your device camera

Deposit checks into checking or savings accounts using the mobile deposit feature.

View e-Statements

e-Statements currently accessed in Online Banking are now available in Mobile Banking.

Touch ID or PIN authentication

Easily and securely log in using fingerprint, facial recognition or personal identification number.

Improved security

Utilizes a one-time passcode to complete certain transactions.

Link other accounts

Transfer funds

Transfer funds between your VirtualBank accounts and setup transfers with external bank accounts.

- User ID – 'Remember Me' capability

- Touch ID® for iPhone®

- Fingerprint Authentication for Android™ phones

- View check images

- Change your password from your phone

- Mobile Deposit limit display

- Auto-capture check image functionality when you deposit your checks

- View up to 90 days of mobile deposit history

- Change to a preferred landing page

- View, add, edit, and delete your payees and payments

- Import payees from contacts

- Select and view favorite payees for easy access

- Make person to person payments

Mobile Deposits

- Download and open our Mobile Banking app on your smartphone.

- Take photos of the back and front of the check(s) that you wish to deposit.

- Once you've successfully submitted your deposit, you'll receive an email confirmation.

- Mobile Deposits made by 8pm ET on a business day will be credited the same day.

Preview some of the features in our video.

Sign up for E-Statements

statements in an instant. Plus, going forward, get up to 18 months of statement history through Online Banking.

Enroll your account(s) in minutes:

- Log into Online or Mobile Banking

- Select a deposit account

- Select 'Documents'

- Click on 'Documents and Settings'

- Enroll 'All Accounts,' or place checkmarks next to account(s) you wish to enroll

- Click 'Save Settings'

Mobile Banking FAQs

How do I sign out of the Mobile Banking app?

When you close the Mobile Banking app, you are automatically signed out.

Who do I contact with any questions about the app?

Any questions in reference to the feature/functions or issues relating to the app can contact our Client Service

at 1-877-998-BANK (2265).

How do I use the 'organize accounts' feature to see my accounts in a certain order?

View the tutorial.

Can I send secure messages within the app?

Secure messaging is currently not available in the app but will be available in a future enhancement.

Is the email option available in the app a secure way to send information about my account?

Bank Of America Mobile Deposit Endorsement

- View, add, edit, and delete your payees and payments

- Import payees from contacts

- Select and view favorite payees for easy access

- Make person to person payments

Mobile Deposits

- Download and open our Mobile Banking app on your smartphone.

- Take photos of the back and front of the check(s) that you wish to deposit.

- Once you've successfully submitted your deposit, you'll receive an email confirmation.

- Mobile Deposits made by 8pm ET on a business day will be credited the same day.

Preview some of the features in our video.

Sign up for E-Statements

statements in an instant. Plus, going forward, get up to 18 months of statement history through Online Banking.

Enroll your account(s) in minutes:

- Log into Online or Mobile Banking

- Select a deposit account

- Select 'Documents'

- Click on 'Documents and Settings'

- Enroll 'All Accounts,' or place checkmarks next to account(s) you wish to enroll

- Click 'Save Settings'

Mobile Banking FAQs

How do I sign out of the Mobile Banking app?

When you close the Mobile Banking app, you are automatically signed out.

Who do I contact with any questions about the app?

Any questions in reference to the feature/functions or issues relating to the app can contact our Client Service

at 1-877-998-BANK (2265).

How do I use the 'organize accounts' feature to see my accounts in a certain order?

View the tutorial.

Can I send secure messages within the app?

Secure messaging is currently not available in the app but will be available in a future enhancement.

Is the email option available in the app a secure way to send information about my account?

Bank Of America Mobile Deposit Endorsement

No, the email option in the app should only be used for general questions or product information.

You should never enter your account number, login credentials or other non-public information in a

regular email.

How does the new feature of connecting to an institution work? Hallmark casino no deposit bonus codes march 2019.

Connecting to an institution allows you to view your account information at other participating

financial institutions. Not all banks participate, so if your bank is not in the top 25 pick list you can try

entering your bank name in the search field. If your bank participates it will ask you to enter the login

credentials you use for that bank. If the bank does not participate, you will receive a message stating

'We don't recognize this institution'.

Have more questions? Feel free to contact our Client Service Department at 1-877-998-BANK (2265)

Android is a trademark of Google, Inc.